Description Founded in 2004, Meadows Urquhart Acree & Cook, LLP is a fast-growing CPA firm of about 40 employees. We provide tax, assurance, and consulting services to mid-sized privately held companies, high net worth individuals, nonprofits and financial services. We work with clients who value consultative relationships and want to reach their potential. Our “In […]

Retirement Plans Made Simpler & Easier for Small Employers

Recognizing that many employees of small businesses are not covered by an employer sponsored retirement plan, both Congress and the Virginia General Assembly have been proactive in passing legislation that encourages more retirement plan participation. From Congress, we have the Secure Act 2.0, aka SECURE 2.0. There are two important provisions made available to small […]

Auto Mileage Rate Allowance Changes January 1, 2023

The IRS has announced a 3 cent per mile increase in the optional standard mileage rate effective on January 1, 2023. These rates can be used to calculate the deduction for the use of a vehicle for business travel or for medical and moving expenses as an alternative to tracking the actual costs of operating […]

Residential Home Energy Credits

Making your home more energy efficient may become less expensive thanks to two valuable income tax credits for energy-efficient home improvements that were extended and expanded in the “Inflation Reduction Act of 2022.” Beginning in 2023, Homeowners can now obtain increased tax credits for Energy Efficient Home Improvement Credits. Increased Residential Clean Energy Credits were made […]

2022 Year-End Tax Planning

“It’s hard to believe we are already in the final quarter of 2022. As we begin looking forward to the possibilities of a new year, we believe it’s important to take a moment to look back and review 2022 for year-end tax planning opportunities. We believe examining your 2022 tax situation before year-end could lead […]

Virginia Pass-Through Entity Tax

Virginia partnerships and S corporations, defined by Virginia as Pass-Through Entities (“PTEs”), should consider paying state income taxes by December 31 in order to obtain a 2022 federal tax deduction. The new Virginia Pass-Through Entity Tax (“PTET”) law will potentially allow individual owners of pass-through entities (“PTEs”) to have the PTE pay their state […]

Inflation Reduction Act Summary

The recently enacted Inflation Reduction Act of 2022 included new taxes on large C corporations and many new credits available to businesses and individuals. For your convenience, here is an easy-to-read summary of those tax provisions, courtesy of Thomson Reuters. We look forward to discussing with you any of these new changes that may affect […]

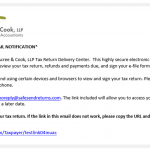

SafeSend Returns

Clients, Exciting news! In an effort to improve our client deliverable experience, we are converting to SafeSend Returns for electronic delivery of tax returns as of August 22, 2022. SafeSend Returns is a user-friendly and highly secure technology solution that allows you to access your tax returns from the convenience of a computer or smartphone. […]

Tax Law Changes Included in Recently Signed VA Budget

2022 One-Time Tax Rebate Taxpayers may receive a rebate payment of up to $250 for single filers and $500 for married filers. Eligibility is determined by your net tax liability minus any credits claimed against that liability on your 2021 tax returns. Rebates for taxpayers that filed 2021 tax returns prior to July 1st, 2022 […]

Home Sale Exclusions

Real estate values have risen significantly, and it has created increased desire to sell property. Many clients have sought to capitalize on the appreciated value of their homes, and they ask about the tax implications of the capital gains they recognize upon sale of their primary residence. Here is helpful information on the home sale exclusion […]