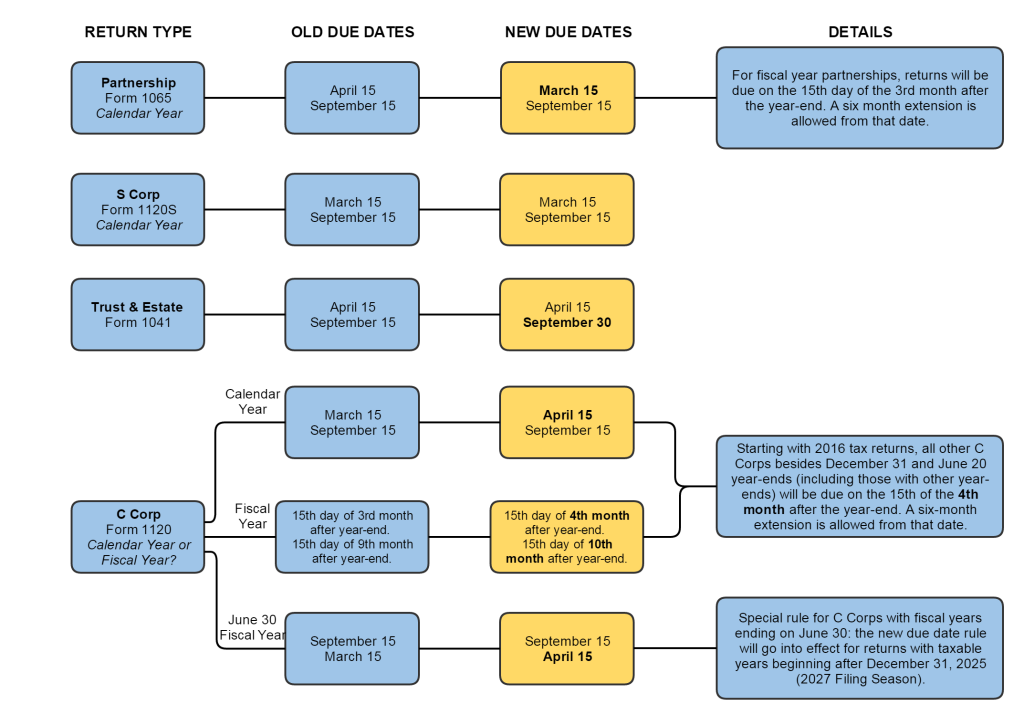

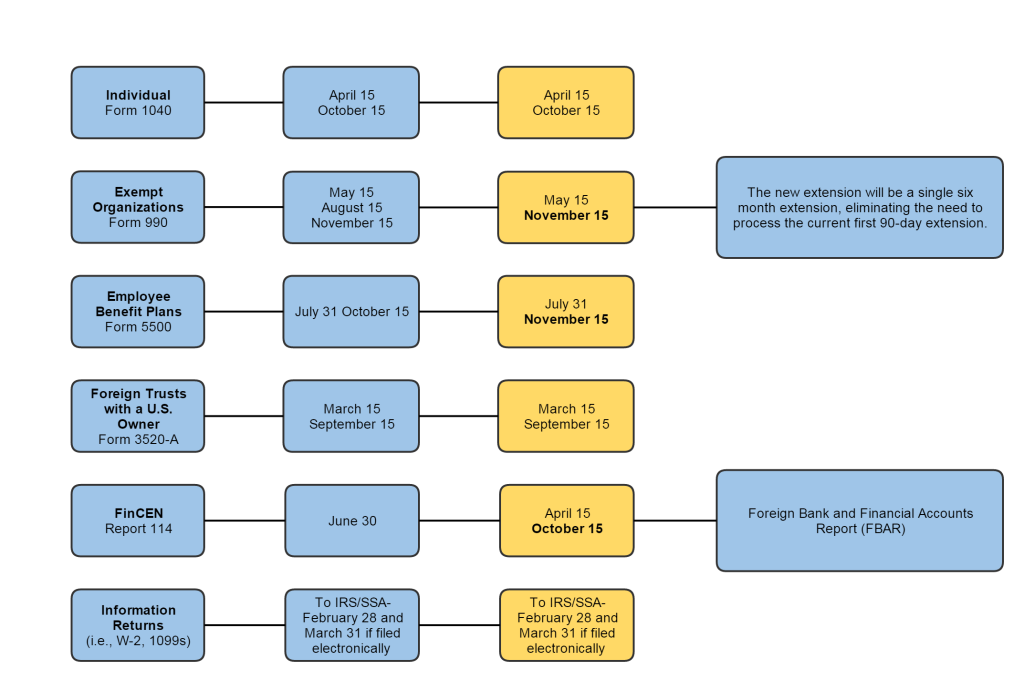

Mark your calendar! Last summer, legislation was signed that updated the deadlines for several types of tax returns. The new tax return due dates apply to the 2017 filing season (2016 tax returns).

The AICPA (American Institute of Certified Public Accountants) had been advocating since 2006 for changes to various tax return due dates. One of the main concerns was that some entities’ Schedules K-1 (containing investment information) would arrive within days, and sometimes even after, the extended due date of their partners’ or owners’ personal returns. This made it nearly impossible to file in a timely and accurate manner. Accountants had to use estimates to file Form 1040 Individual Tax Returns because Form 1065 Partnership Tax Returns were due the same day.

The new law was passed hoping to create a more logical flow of information that will be helpful for many filers. We hope to see more timely and accurate K-1s, which should ultimately mean less extensions, estimates, and amended returns.